China, the world’s largest importer of crude oil, reported yesterday an unexpected contraction in manufacturing activity in January, adding to concerns over global crude demand growth. Weak PMI readings in China cast further doubt on China’s oil demand outlook, which could have a dampening effect on prices.

Several refineries in China have halted operations or plan to do so for indefinite maintenance periods.

In addition, higher-than-normal temperatures are forecast in the US this week, which will affect demand for heating fuels after extreme cold weather sparked higher natural gas and diesel prices in previous sessions.

Overall market caution is likely to persist as the February 1 deadline for the US tariffs approaches, as any potential trade restrictions are likely to reduce global growth, which could result in lower oil prices.

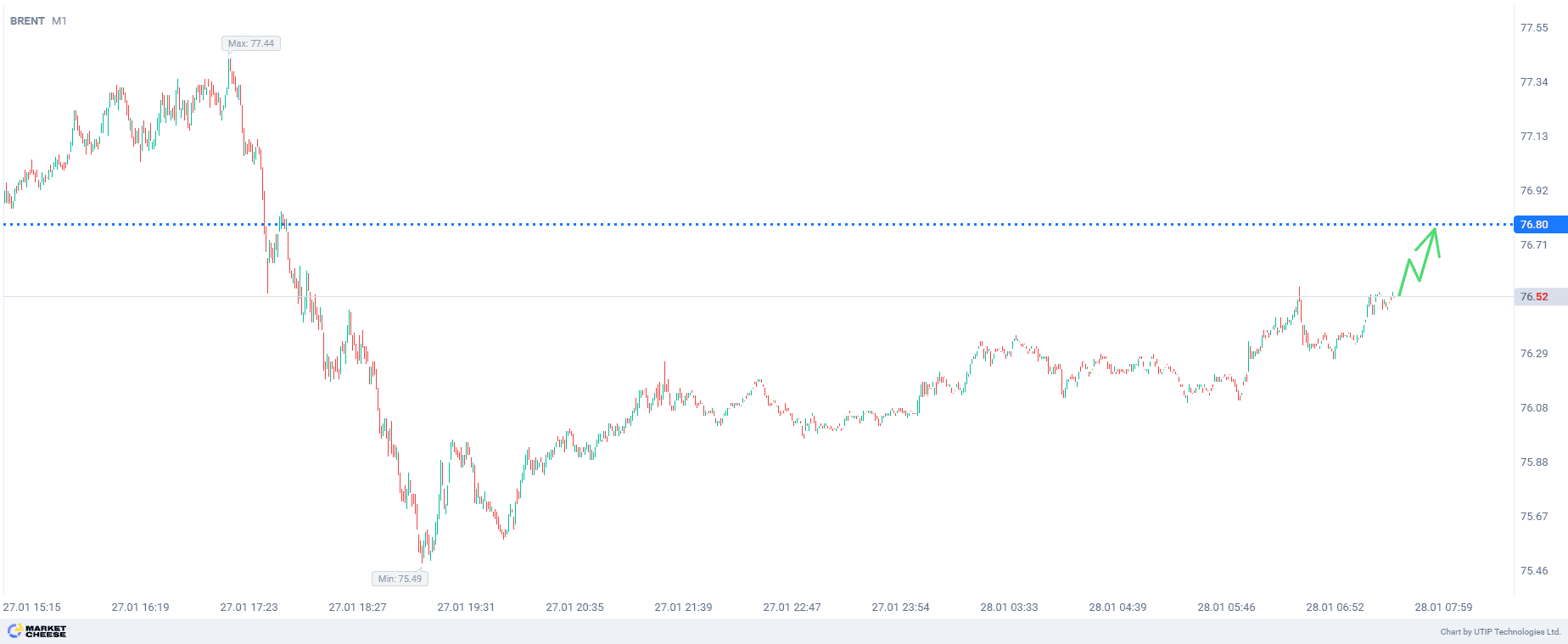

From a technical point of view, after yesterday’s sharp decline in Brent oil prices, there were a number of levels that were not retested. Among them, we can single out the level of 76.8, which Brent prices are likely to test before the end of the current week. The upward momentum for this movement will probably be provided by today’s US Durable Goods Orders. The orders are expected to increase steadily, which will strengthen demand for energy in the medium term.

The overall recommendation is to buy Brent oil.

Profits should be taken at the level of 76.8. A Stop loss could be set at the level of 76.2.

The volume of the opened position should be set in such a way that the value of a possible loss, fixed with the help of a protective Stop loss order, is no more than 1% of your deposit funds.