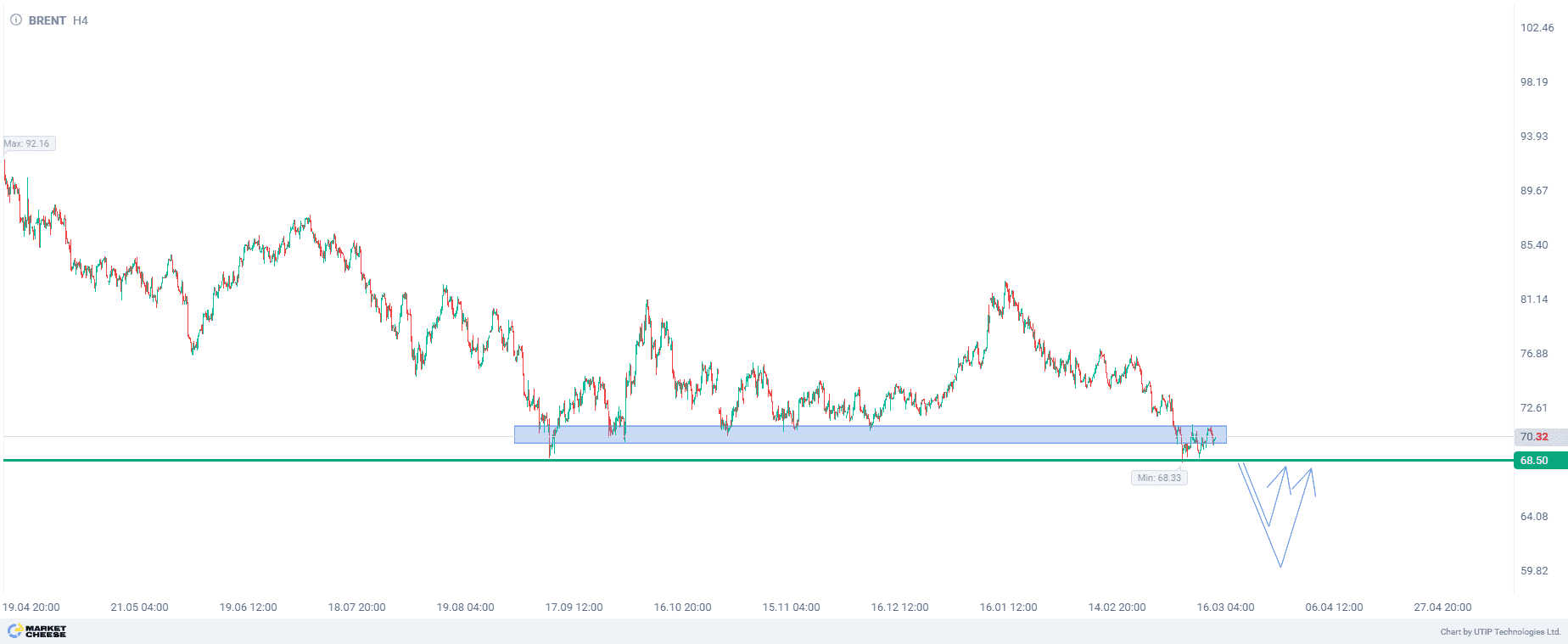

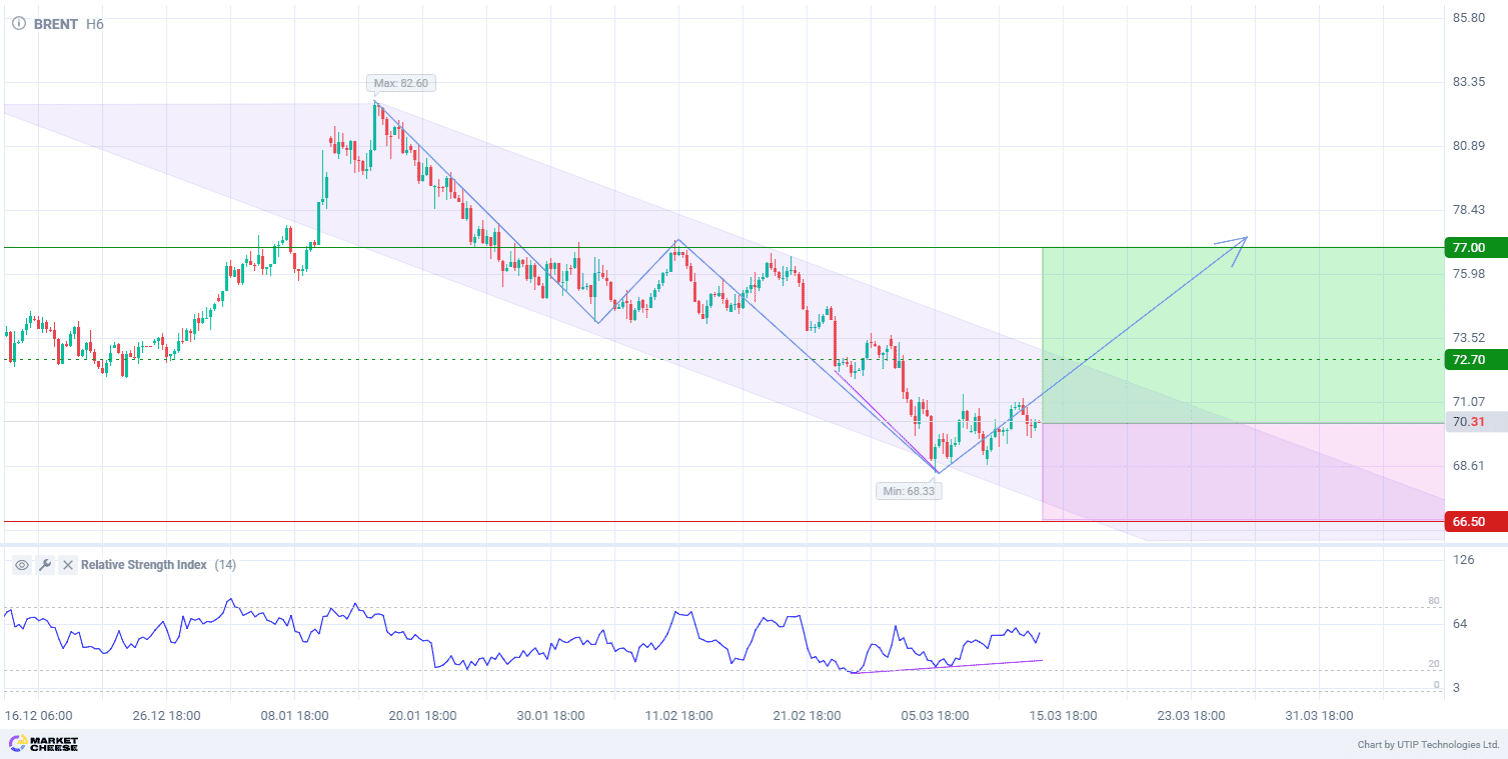

Brent oil prices have been consolidating for the second week in the zone of strong multi-year support at $70 per barrel. There is a high possibility that prices will at least break through this level, approximately to the range of $60–65 per barrel. Fundamentally, such a scenario is supported by the Trump-driven trade war, which will lead to a slowdown in the global economy and a drop in energy demand. Another bearish factor remains, as before, weak Chinese economic data and lower potential Chinese demand for oil.

The International Energy Agency reported that global oil supply may exceed demand by about 600 000 barrels per day (bpd) this year. At the same time, world demand is expected to rise by only 1.03 million bpd, down 70 000 bpd from last month’s forecast. The report cited deteriorating macroeconomic conditions, including escalating trade tensions.

OPEC+ has exported a record amount of refined products, easing the impact of the group’s restrictions on crude production. Group members, including Saudi Arabia, seek to increase their revenues and market share. Cartel members may boost exports of fuel products — if they have sufficient refinery capacity — without violating their commitments to the group.

Seaborne fuel exports from the OPEC+ Gulf countries of Iraq, Kuwait, Oman, Saudi Arabia and the United Arab Emirates hit an all-time high of an average of 5.51 million bpd (bpd) in 2024, up more than 7% from the previous year.

Citi analysts said their forecast for the price of Brent oil by the second half of 2025 is $60 a barrel.

At the same time, the breakdown of Brent oil to the level of 70 will activate additional sales by trading algorithms monitoring the oil market. This will strengthen the decline in prices for some limited period of time, after which there will be an inevitable pullback to the level of $70 per barrel.

The overall recommendation is to buy Brent in case of a decline in prices to the range of $60–65 per barrel.

Profits should be taken at the level of 70.0. A Stop loss could be set at the level of 55.0.

The volume of the opened position should be set in such a way that the value of a possible loss, fixed with the help of a protective Stop loss order, is no more than 1% of your deposit funds.