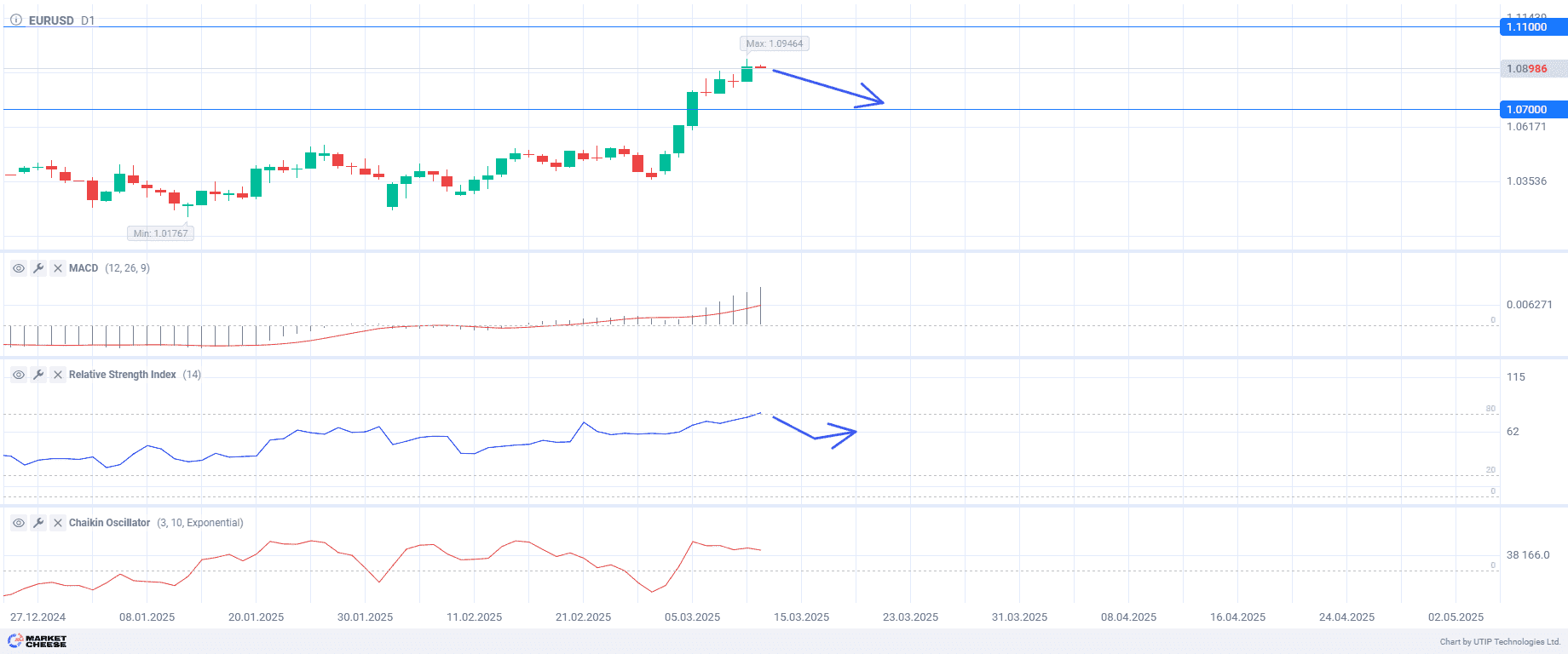

At the moment, EURUSD is in an uptrend. Since the beginning of March, it has risen by 4.14%. On Wednesday, March 12, the price opened at 1.09103, reaching a four-month-high. This increase was due to hopes of an agreement on defense spending in Germany, which strengthened the euro. At the same time, the US dollar weakened to its lowest levels since October, reflecting investor concerns about the US recession.

Stock markets remain volatile amid Donald Trump’s recent interview on Fox News. It reinforced investor doubts about Trump’s rejection of aggressive trade policies. That in turn has led to a weaker dollar, higher Treasury bond prices and a broad stock sell-off as traders fear tariffs and political uncertainty may harm the US economy.

Economic data from the US confirms these worries. The Small Business Confidence Index fell for the third consecutive month in February, and the country’s GDP growth forecast got worse. Experts warn that the tariffs could lead to higher prices, reduce consumer spending and worsen the investment climate. The Federal Reserve (Fed) is even consider a rate cut as early as June to support the economy.

Meanwhile, Europe also faces risks. The International Monetary Fund (IMF) warns of a possible slowdown in eurozone GDP growth due to a possible escalation of the trade conflict with the US.

The key event this week will be the release of US inflation data. If the numbers turn out to be higher than expected, it will increase fears of stagflation. Weak data may increase fears of recession. The probability of recession already reached 25–30% this year, according to expert Mohamed El-Erian.

Technical analysis indicates the beginning of correction. RSI reached the overbought zone on March 11, and a rate correction may occur soon. MACD indicator points to the presence of an uptrend with a strong bullish impulse. Chaikin oscillator indicates the prevalence of buyers in the market, but their number started to decline.

Current Recommendation:

Sell EURUSD at the current price in anticipation of the correction. Take profit – 1,07. Stop loss – 1,11.