Markets are in wait-and-see mode, expecting the Fed to hold off on cutting interest rates and hint at further policy moves. They are pricing in almost 50 basis points of cuts this year, or two 25 basis points reductions starting in June, according to the data.

Fed Chair Jerome Powell’s expected press conference will shed some light on the timing and extent of further rate cuts under US President Donald Trump’s second term. Trump’s immigration and trade policies are seen as inflationary, which could prompt the Fed to keep rates high for longer, and that’s unfavorable for the price of gold, which doesn’t generate income through interest.

In case Powell and his colleagues express confidence in disinflation and acknowledge weakening labor market conditions, markets may take this as a sign of easing, increasing the likelihood of further rate cuts, which would likely push the gold price to new highs.

Markets are now recovering from the global sell-off in artificial intelligence companies triggered by Chinese low-cost AI model DeepSeek, and attention is also focused on the reporting results of US tech giants Microsoft, Meta and Tesla, which will be released at the end of the US session today.

If the reported results disappoint and the forecasts do not reassure investors, there could be a new global sell-off in technology stocks and the markets could go into “sell everything” mode. In such a case, the gold price as a safe haven asset could get another strong upward momentum.

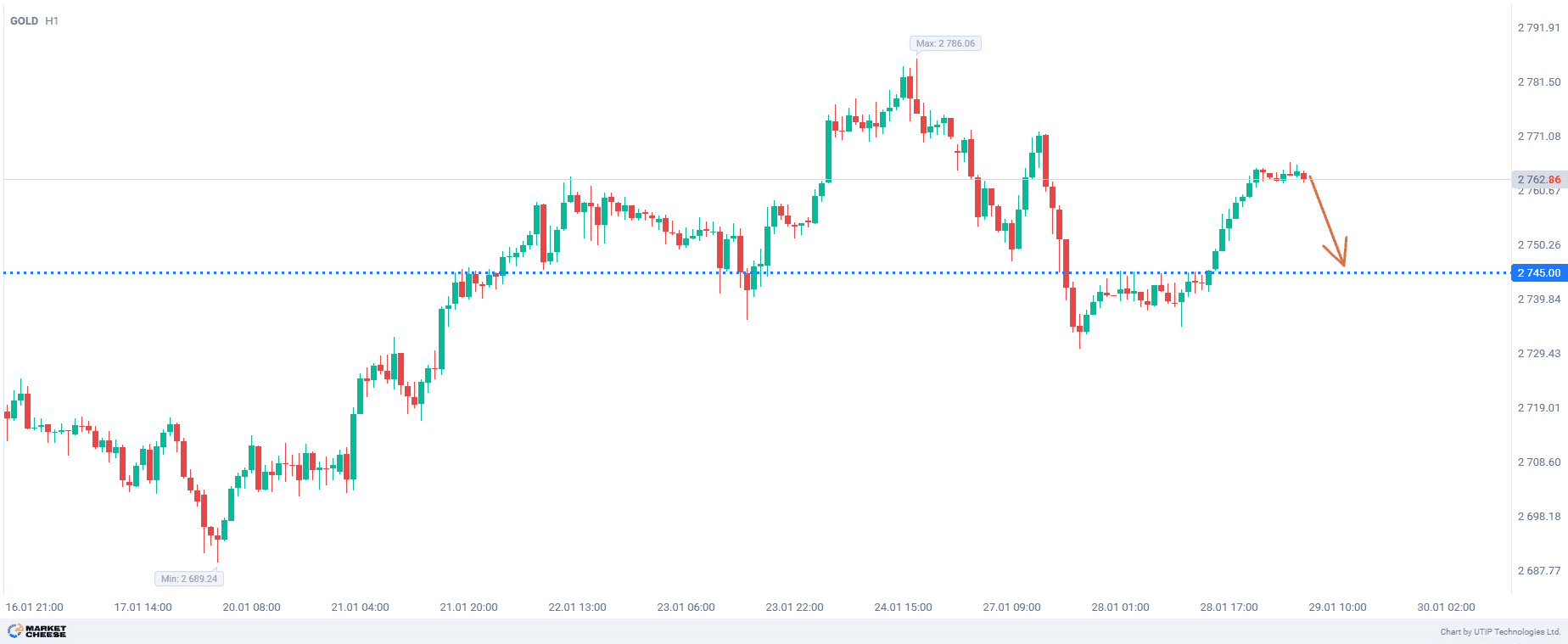

From a technical point of view, the gold price is now aiming at the level of 2745 as support, so it is advisable to consider a short-term selling to this level.

The overall recommendation is to sell gold.

Profits should be taken at the level of 2745. A Stop loss could be set at the level of 2780.

The volume of the opened position should be set in such a way that the value of a possible loss, fixed with the help of a protective Stop loss order, is no more than 1% of your deposit funds.