The AUDCAD currency pair is declining for the second consecutive day on Friday amid the release of key economic data and global trade events.

US President Donald Trump on Thursday suspended the 25% tariffs on Canadian and Mexican goods imposed earlier under the USMCA Agreement. This decision delayed Canada’s second round of retaliatory duties until April 2, easing trade tensions. Therefore, the Bank of Canada (BOC) is expected to postpone rate cuts at its meeting in late March.

Meanwhile, in the 4th quarter of 2024, Australia’s GDP grew by 0.6% compared to the previous quarter (up from 0.3% in the 3rd quarter and expected 0.5%). Year-on-year it grew by 1.3% (from 0.8% previously). Even though the results were stronger than expected, uncertainty over trade policy and economic challenges limited the currency’s appreciation. In addition, the Reserve Bank of Australia (RBA) forecasts economic growth to slow to 2% by 2025, limiting investor optimism for the Australian dollar.

Today’s data on employment in Canada may have a significant impact on the currency pair. According to the expectations of Statistics Canada, employment may fall to 19,700 against the previous 76,000. At the same time, the unemployment rate may increase to 6.7% from 6.6% in January. If the weak data is confirmed, it may put additional pressure on the Canadian dollar.

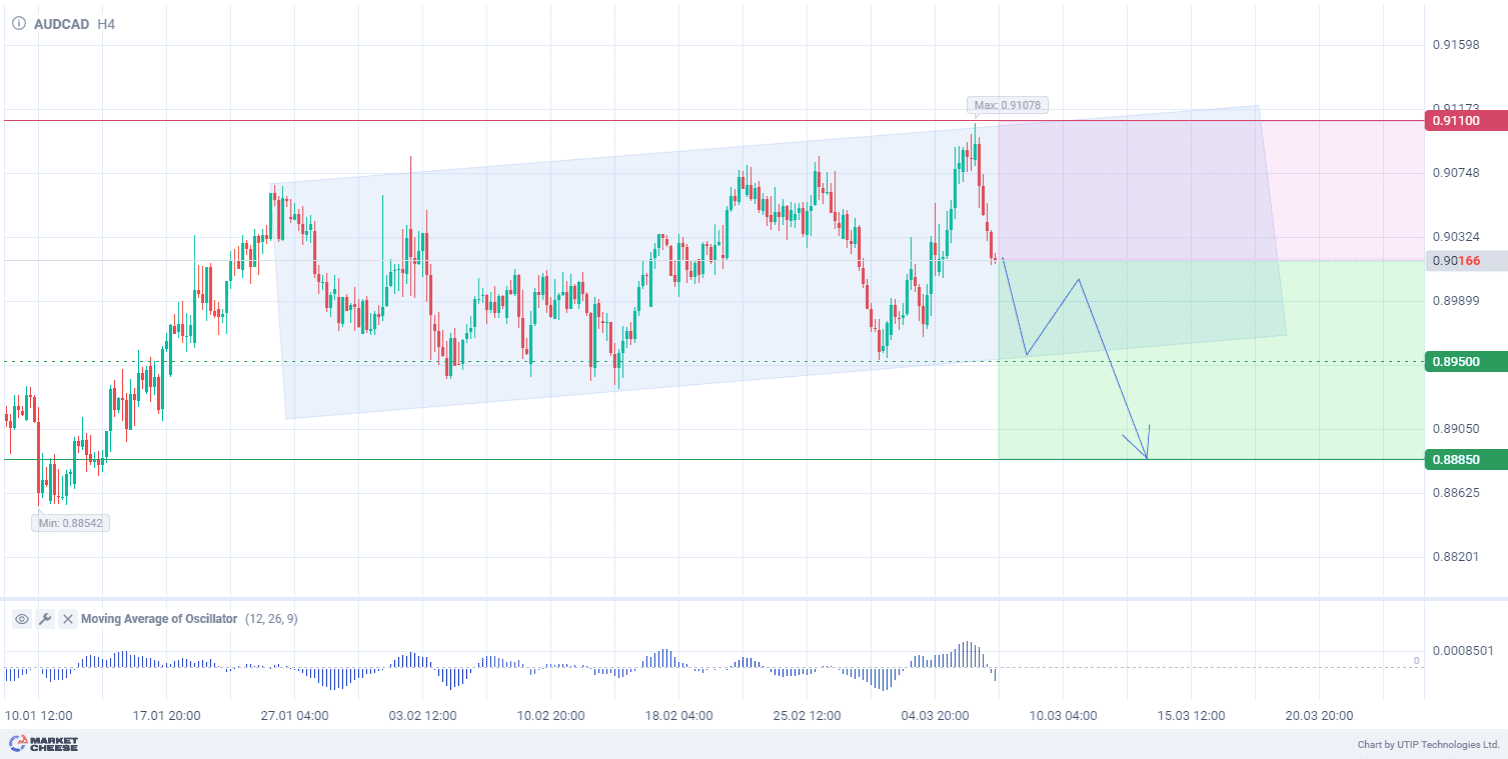

From a technical point of view, the AUDCAD pair is in an upward correction on the H4 timeframe. Being in the mid-channel, the price represents equal strength in the macroeconomic data of the two countries, including global trade sentiment. However, the price tends to move to the channel support. At the same time, the movement may intensify when the channel support is broken, as the Moving Average of Oscillator (with parameters 12, 26, 9) suggests stronger downward momentum in the negative zone.

Short-term prospects for the AUDCAD currency pair suggest selling with the target of 0.8885. Part of the profit should be taken near the level of 0.8950. A Stop loss could be set at 0.9110.

Since the bearish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.