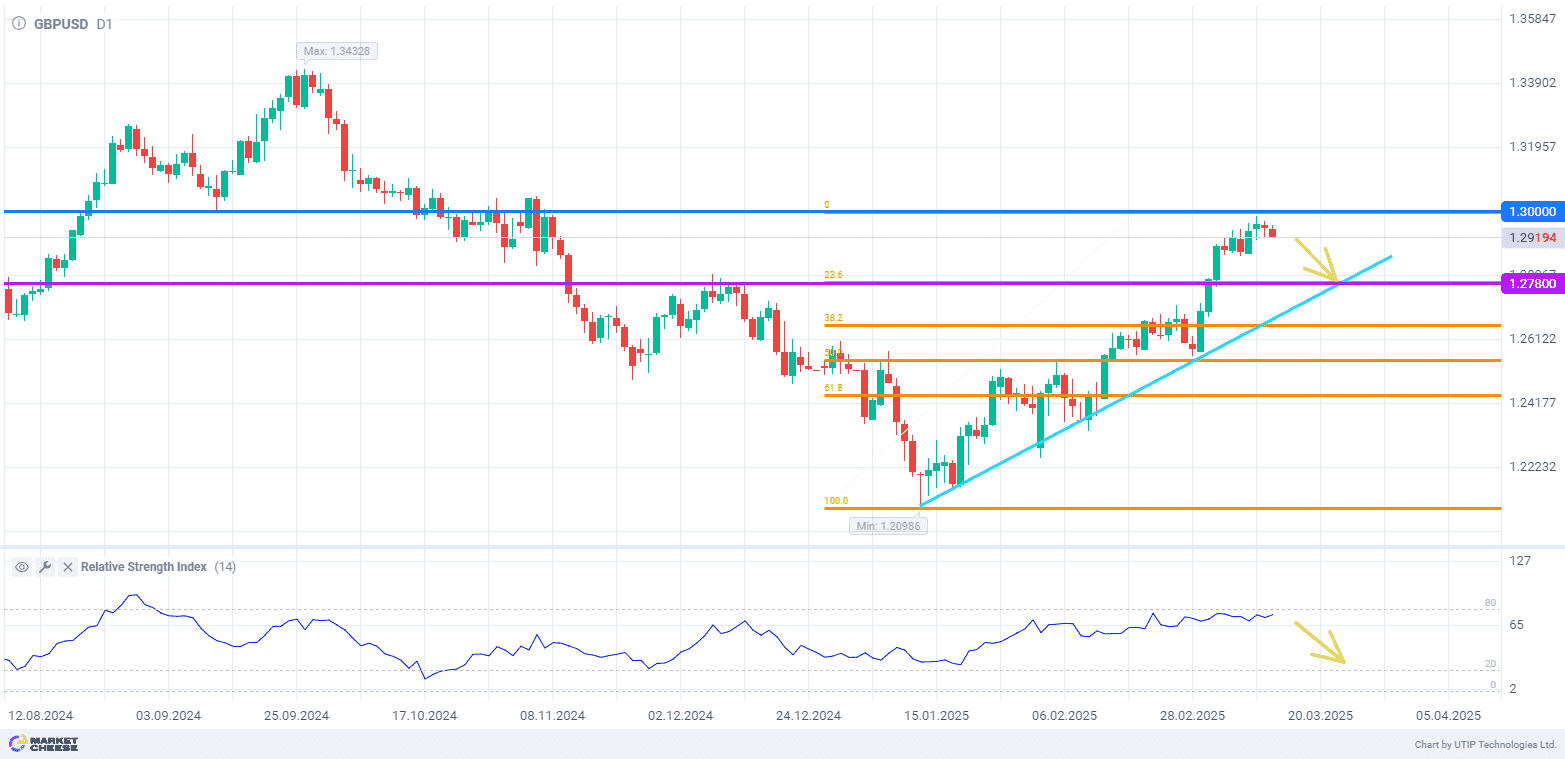

The GBPUSD currency pair this week came close to the important level of 1.3, above which it has not traded since the beginning of November. It seems that it is not possible to overcome this barrier at the first attempt, and market participants start fixing profits on long positions. Quotes are too much detached from the line of medium-term uptrend, buying the pound against the dollar now does not look attractive. The first target of the correction may be the Fibonacci level of 23.6% (mark 1.278).

GBPUSD’s strong recent rise has been driven by growing fears of a possible recession in the US. However, the UK economy does not look sustainable either. This is evidenced by the data released today. UK GDP fell by 0.1% in January, missing forecasts for growth by a similar amount. In annualized terms, the indicator slowed the increase from 1.5% to 1%.

HSBC analysts see risks of economic stagnation in the UK. In their opinion, the growth of defense spending will not be able to significantly change the situation, as this sector accounts for only 0.5% of the country’s GDP. The government’s budget constraints reduce the opportunities to stimulate the economy. Although HSBC raised their GBPUSD forecast to 1.23, they consider the current prices clearly overvalued and do not recommend buying the British currency.

UBS experts hold a similar position. The analyst of the Swiss bank Patrick Ernst believes that the ratio of the pound to the dollar is not yet ready to consolidate above the level of 1.3 and is waiting for a pullback to 1.26. The possibility of testing the support level of 1.25 is also not excluded. Although the UK has so far avoided the aggravation of relations with the US in the context of trade tariffs, the emergence of this scenario on the agenda can dramatically change the situation both in the economy of the European country and in the currency market.

The RSI indicator near the overbought zone increases the chances of a corrective pullback in GBPUSD. The nearest benchmark for the bears is 1.278.

Consider the following trading strategy:

Sell GBPUSD at the current price. Take profit – 1.278. Stop loss – 1.3.