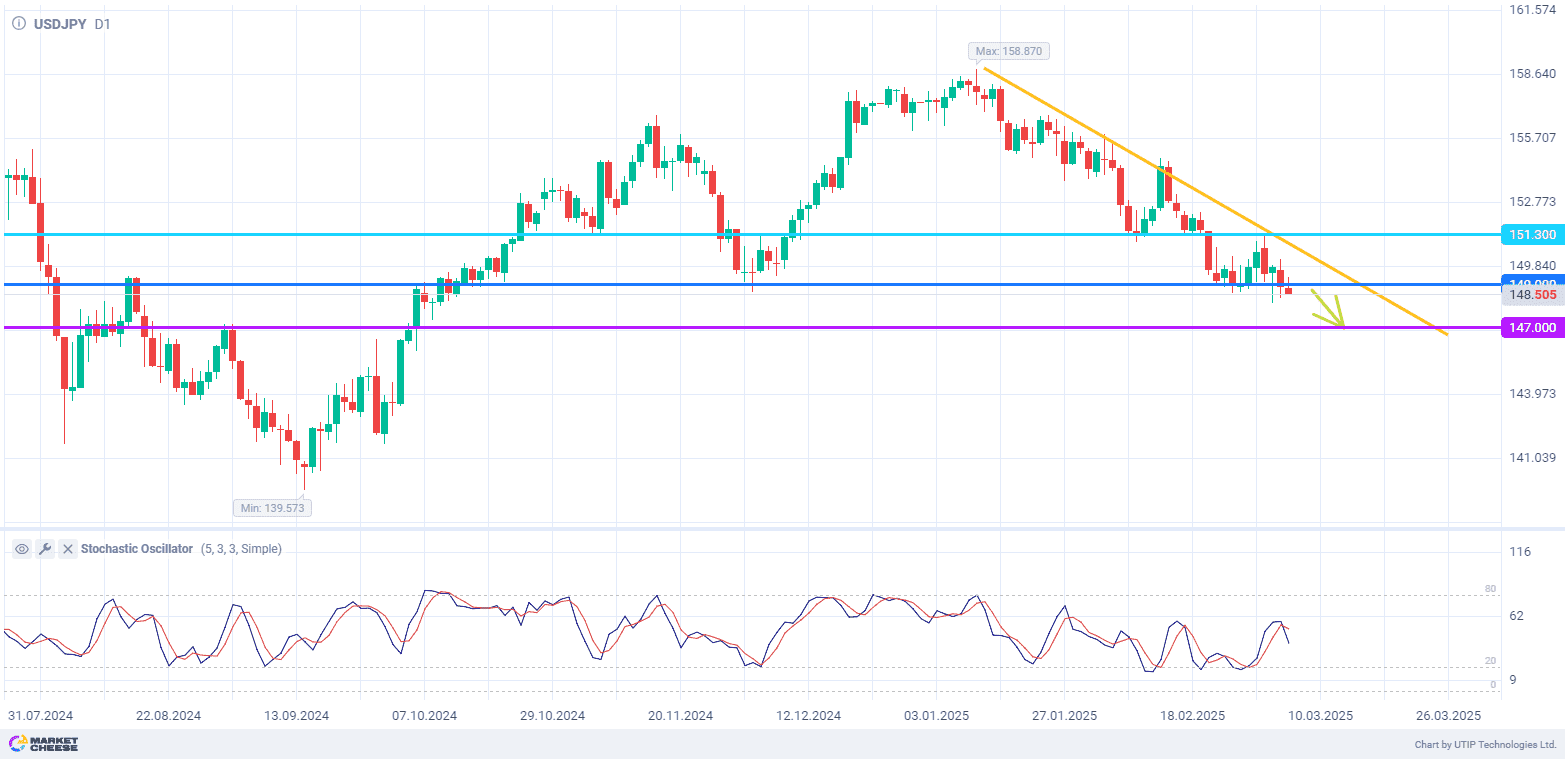

The USDJPY currency pair has been trading in the 149-151 range for the second week, accumulating strength before continuing to move within the medium-term downtrend. The rate has updated its lows since the beginning of October, but a break of the 149 support level has not yet been observed. However, both the fundamentals and the technical picture support further strengthening of the yen against the dollar. Increasing bearish pressure could send USDJPY to 147 in the coming days.

The U.S. currency is weakening amid a sharp rise in bond yields of other countries, including Japan. The Asian country’s 10-year bonds are trading today with yields above 1.5% for the first time since 2009. Meanwhile, 40-year bonds have hit a record since 2007. Keisuke Tsuruta of Mitsubishi UFJ Morgan Stanley Securities says the current level of Japanese bond yields is an important milestone for the market, but traders are unlikely to stop there.

Analysts at BNP Paribas Asset Management are boldly predicting that the USDJPY will fall to 130, a drop of almost 15% from current levels. According to the experts, the Bank of Japan will continue to raise interest rates due to steady inflation. At the same time, the Fed will be forced to continue easing monetary policy amid signs of deterioration in the U.S. economy.

James McElevy of BNP Paribas points to the actions of hedge funds, whose short positions on the yen have reached a minimum since October. He does not expect the dollar/yen ratio to reach 130 in the coming weeks or months. Nonetheless, McElevy recommends building long positions in the yen, especially during periods of temporary weakness. With Donald Trump’s aggressive policies, the Japanese currency may become even more attractive as a safe-haven asset than the dollar.

The Stochastic indicator has turned downward, giving a sell signal for the USDJPY. The next downside target is the 147 level.

Consider the following trading strategy:

Selling USDJPY at the current price. Take profit – 147. Stop loss – 151.3.