Brent oil moderately rose on Friday, trading above $70 per barrel as the US tightened measures against Iran and Russia. This partially offset a 1.5% drop on Thursday due to a pessimistic demand outlook from the International Energy Agency (IEA).

The White House imposed sanctions against Iran’s oil minister and expanded the list of companies and ships used to transport Iranian oil. Measures were also imposed to restrict the methods of payment for Russian energy products.

Thursday’s decline was due to the IEA statement, which forecasts an increase in oversupply in the oil market. Increasing trade confrontation and OPEC+ production recovery put pressure on demand. As a result, the Brent price is on the verge of its fourth weekly decline.

However, optimism remains in the short term as Canadian tariffs on energy and growing supply disruptions from Iran and Venezuela continue to keep the market under pressure.

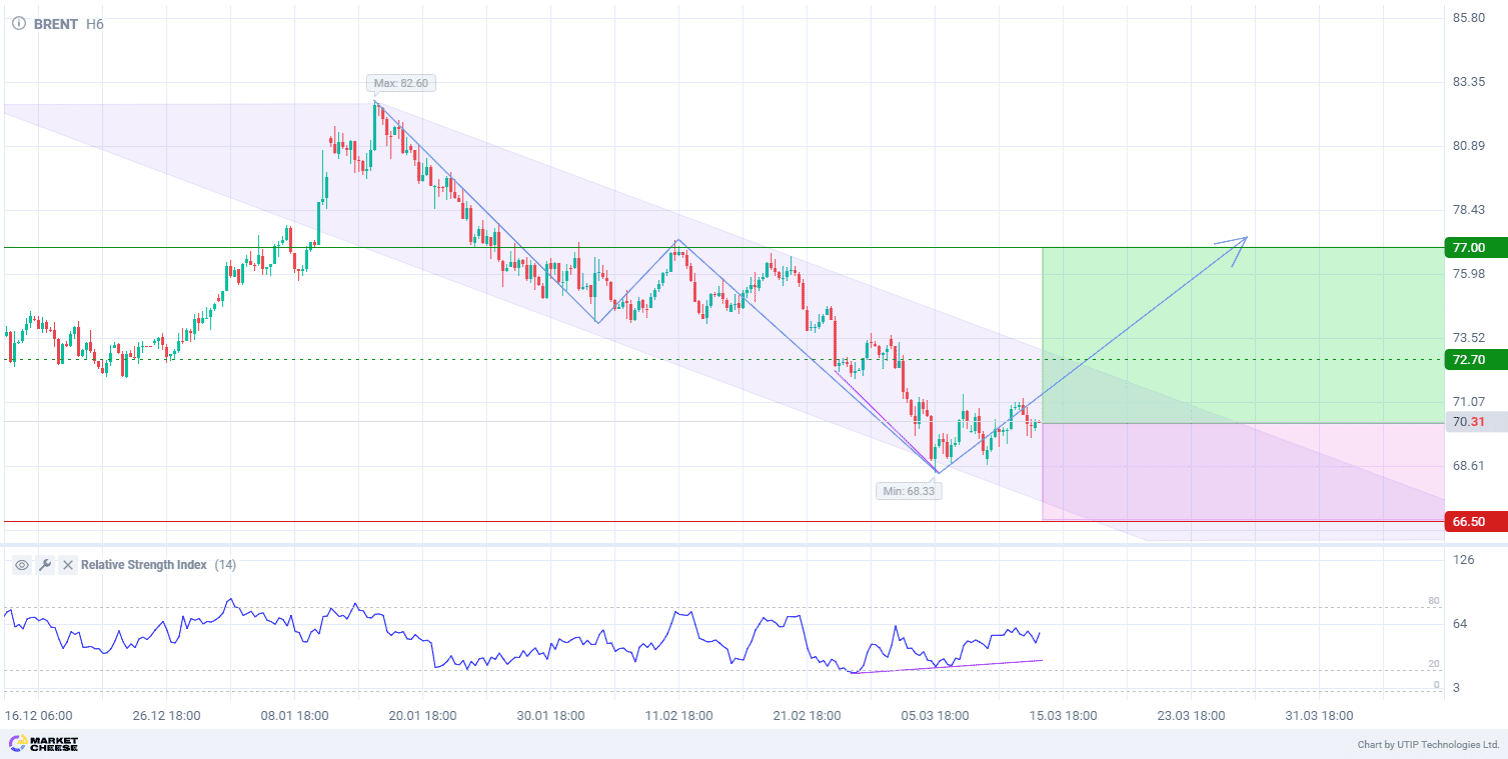

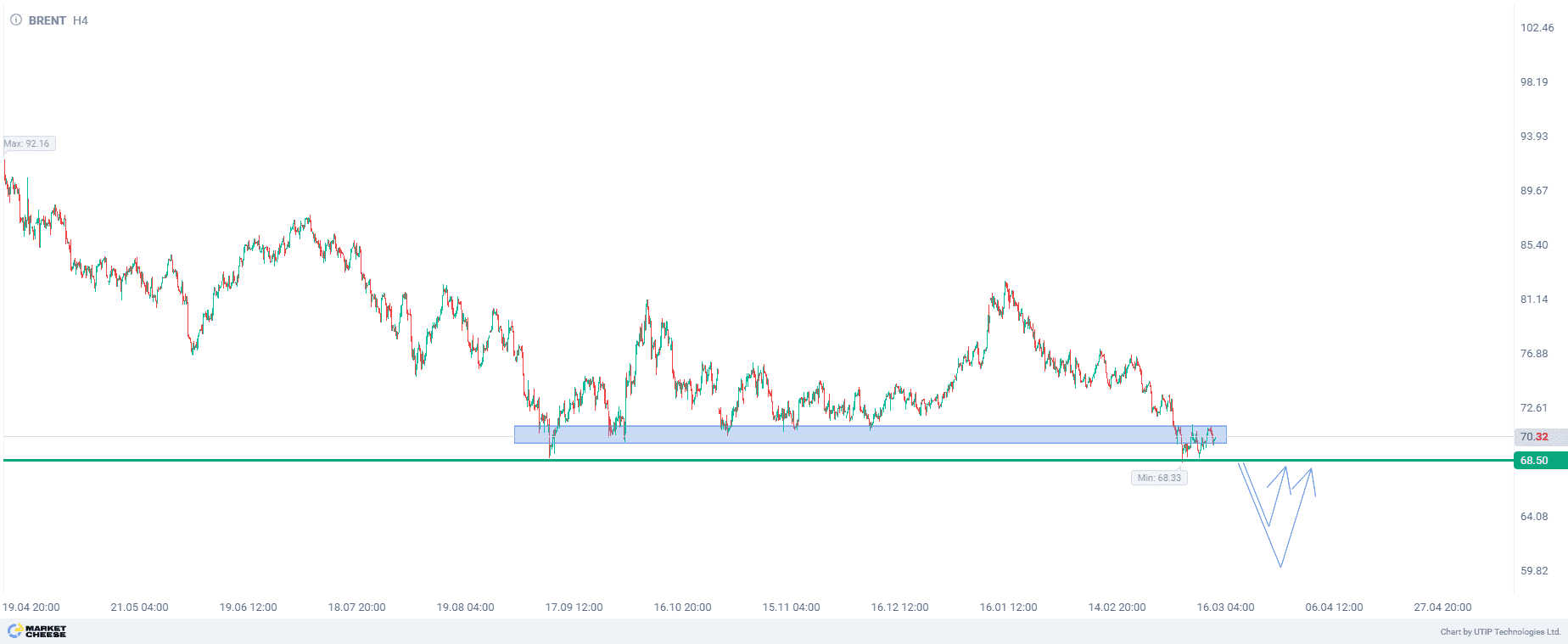

From a technical point of view, Brent oil prices are in a downtrend on the H6 timeframe. The wave structure indicates the formation of the third downward wave. However, the Relative Strength Index indicator (period 14) shows divergence. This signals a possible change of trend and the transition of the third wave to the fourth. If the pullback from the minimum of 68.33 became the final stage for the third wave, then its structure has a shortened cycle. This factor implies a complete change in the direction of price movement and exit from the downtrend with a transition to a new upward trend.

Short-term prospects for Brent oil prices suggest buying, with the target of 77.00. Part of the profit should be taken near the level of 72.70. A Stop loss could be set at 66.50.

Since the bullish scenario is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.