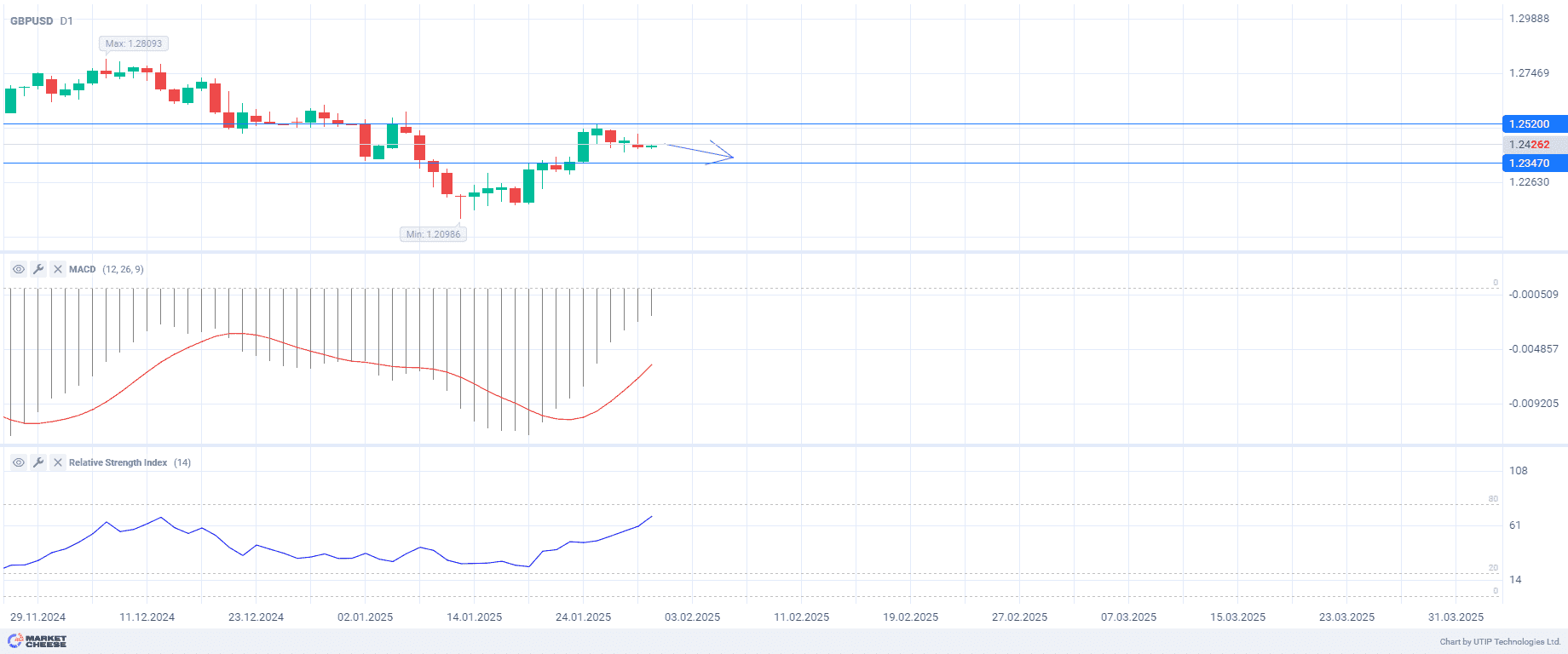

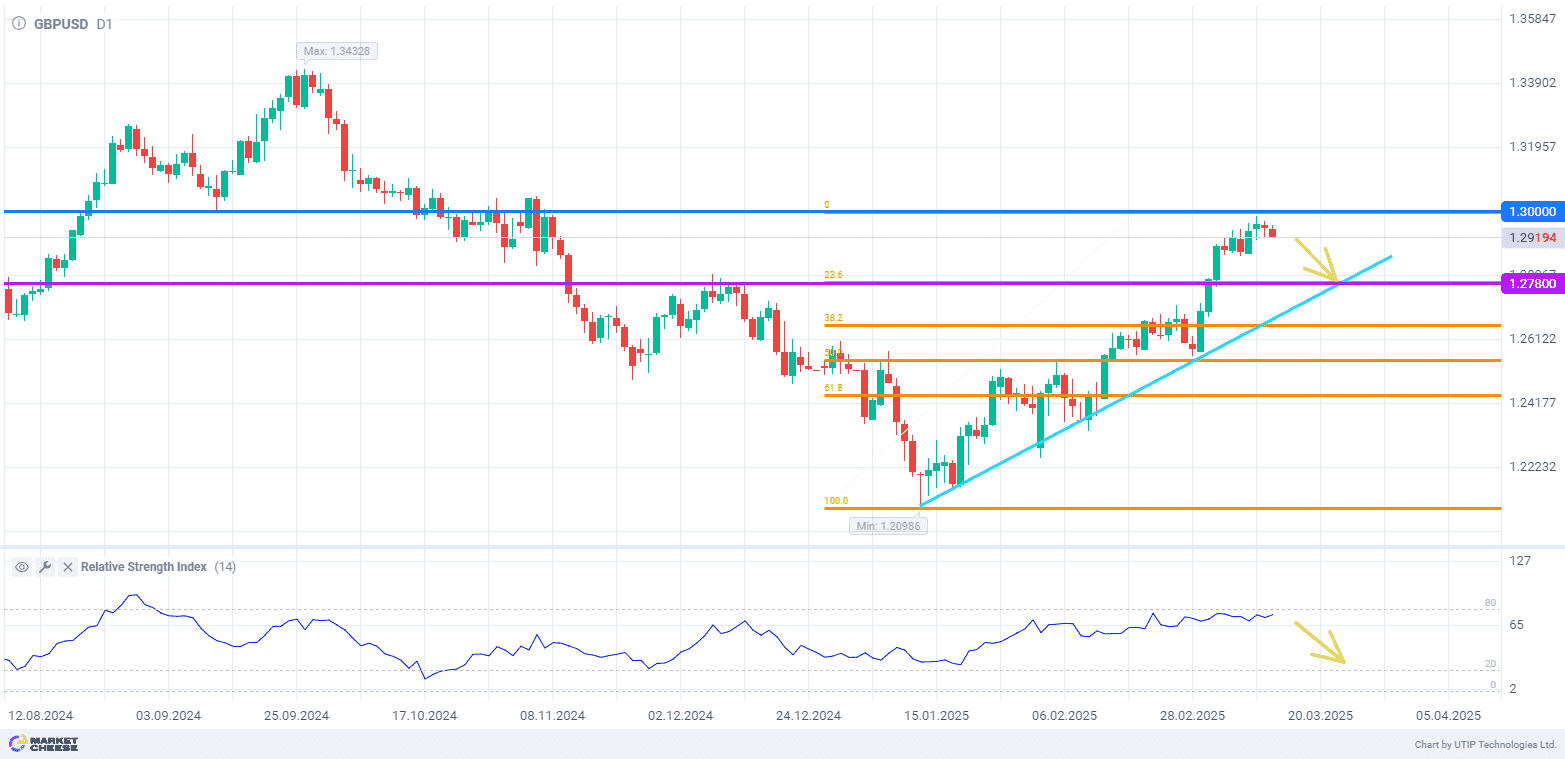

After reaching a low of 1.20986 in mid-January, GBPUSD quotes managed to recover to 1.24981. Since January 27, GBPUSD underwent a slight correction, and on Friday, the opening price was 1.24298.

In the last quarter of the year, the US GDP growth slowed down to 2.3%, not meeting expectations and falling short of the previous period’s figures. The decline in investment was a significant factor, offsetting some of the positive impact from increased consumer and government spending. However, the US labor market remains stable, with a drop in jobless claims and an increase in real consumer spending. These factors, along with the Federal Reserve’s decision to keep interest rates steady and the Fed Chair’s cautious stance on monetary policy, provided support for the dollar.

In the UK, investors are keeping a close eye on Treasury chief Rachel Reeves’ plans to stimulate the economy. In particular, the project Oxford-Cambridge Growth Corridor is expected to be delivered, which can bring £78 billion to the economy. Successful implementation of these measures may strengthen the British pound.

On Friday, the Personal Consumption Expenditures Price Index is due out, which is projected to rise 0.2% compared to November 2024. Another big event is Trump’s promise to impose tariffs on goods from China, Mexico and Canada, which will come into force on February 1. These measures could increase demand for the dollar as a safe haven amid increased trade uncertainty. In addition, the tariffs may spark inflation in the US, which could push the Fed to raise interest rates, thereby strengthening the national currency further.

Technical analysis shows uncertainty in the market. The MACD indicates a possible weakening of the downtrend and that the downward price trend may be slowing down. The RSI is above the level of 61 and is directed upwards, which indicates the strength of the current uptrend. However, its approach to the overbought zone may indicate the possibility of a trend reversal or corrective movement. The macroeconomic indicator of the currency pair is neutral, pointing to the continuation of the current trend.

Current recommendation:

Sell at the current price. Take profit – 1.23470. Stop loss – 1.25200.