GBPUSD has gained 1.42% since March 3, rising from 1.27007 to 1.28807 on Thursday. Friday’s trading opened at 1.28803.

The rate growth is explained by the weakening of the US dollar, which was caused by investor pessimistic sentiments about the country’s economic growth amid trade tensions initiated by the Donald Trump administration. Although the US President on Thursday exempted Canadian and Mexican imports from the 25% duties for a month — just two days after they were imposed — the dollar has only partially regained its strength. The uncertainty is undermining investor confidence domestically, and they are starting to turn their attention to other currencies.

Based on the current news, analysts expect the Fed to keep interest rates in the 4.25–4.50% range at its meeting on March 18–19.

At the same time, the outlook for the UK economy is also deteriorating. The Association of British Chambers of Commerce (BCC) has lowered the country’s economic growth forecast for 2025 and 2026. In addition, British companies expect more rapid price increases over the next 12 months, according to the Bank of England (BOE) survey.

Both countries are experiencing employment-related problems. In the US there are large-scale layoffs of federal employees, while in the UK ordinary workers are losing their jobs due to upcoming changes in legislation.

The next important event will be the release of the non-farm payrolls data and the US unemployment rate on March 7. According to official forecasts, the number of employed is expected to rise, but this may be due to the fact that the data were collected before many of the recent layoffs. ADP Research estimates that the private sector added less than half as many jobs as in the previous period. A similar situation is seen with the outlook for unemployment. While the official forecast is 4%, or the same level as in January, it is hardly believable due to the current policy regarding government personnel.

In general, the US and UK economies seem to be facing difficulties, therefore the exchange rate volatility decreases and shifts to consolidation. With no more news, the most probable option is the continuation of the flat movement. The situation may be affected by new information on Donald Trump’s protectionist policy.

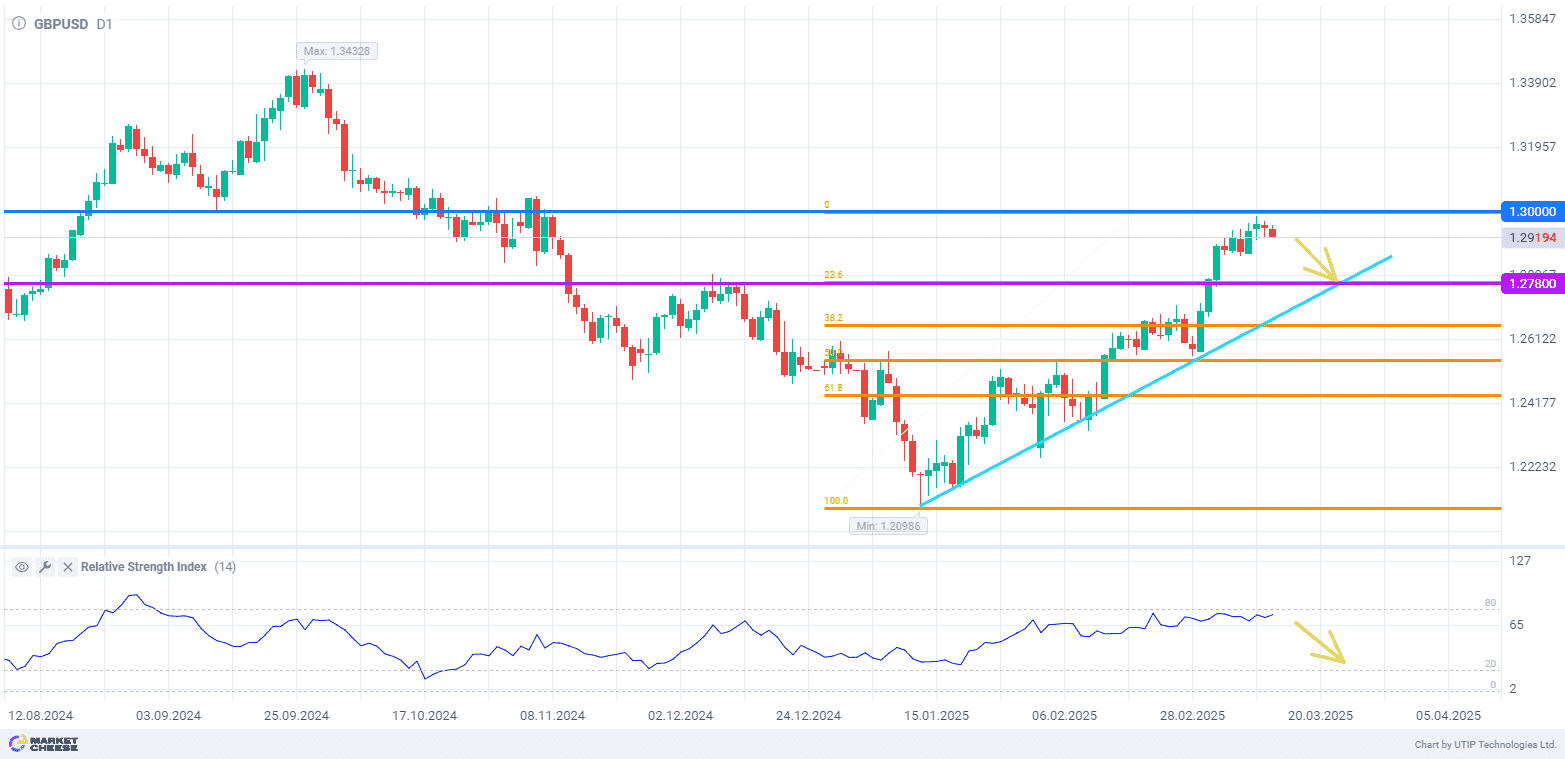

Technical analysis of the daily timeframe indicates the beginning of consolidation after Thursday, with almost no daily volatility. On Friday morning the MACD was positive, indicating the presence of an uptrend. The MACD line is above the signal one which also confirms the bullish trend. The RSI is 71, indicating the proximity to the overbought zone and the presence of a bullish momentum, so the price correction is possible. The Chaikin oscillator is at the level of 75,272.6, indicating strong buying interest and bull predominance in the market.

Current recommendation:

With the rate close to the overbought zone and the outlook for the UK economy becoming more and more pessimistic, it is recommended to sell at the current price. Take profit — 1.27500. Stop loss — 1.30000.