The AUDCAD currency pair shows moderate growth after US President Donald Trump’s statements regarding the possible imposition of tariffs on Canada, Mexico and China. These announcements sparked concern among investors, increasing pressure on the Canadian dollar.

The Canadian currency remains under pressure due to the dovish stance of the Bank of Canada and the risks of imposition of trade duties by the United States. The regulator continued easing monetary policy, lowering interest rates on Wednesday for the sixth consecutive time since June, and also announced the end of the quantitative tightening.

An additional negative factor was Trump’s re-announcement of plans to impose 25% duties on Canada, increasing uncertainty on the market.

Traders are still reluctant to place aggressive bets ahead of the release of Canada’s monthly GDP on Friday. However, this data may increase the volatility after its publication.

The Australian dollar also came under pressure after leading Australian financial institutions forecast a possible 25 basis point rate cut by the Reserve Bank of Australia in February. Earlier, a reduction was expected in May, but worsening economic conditions led to a revision of the forecast.

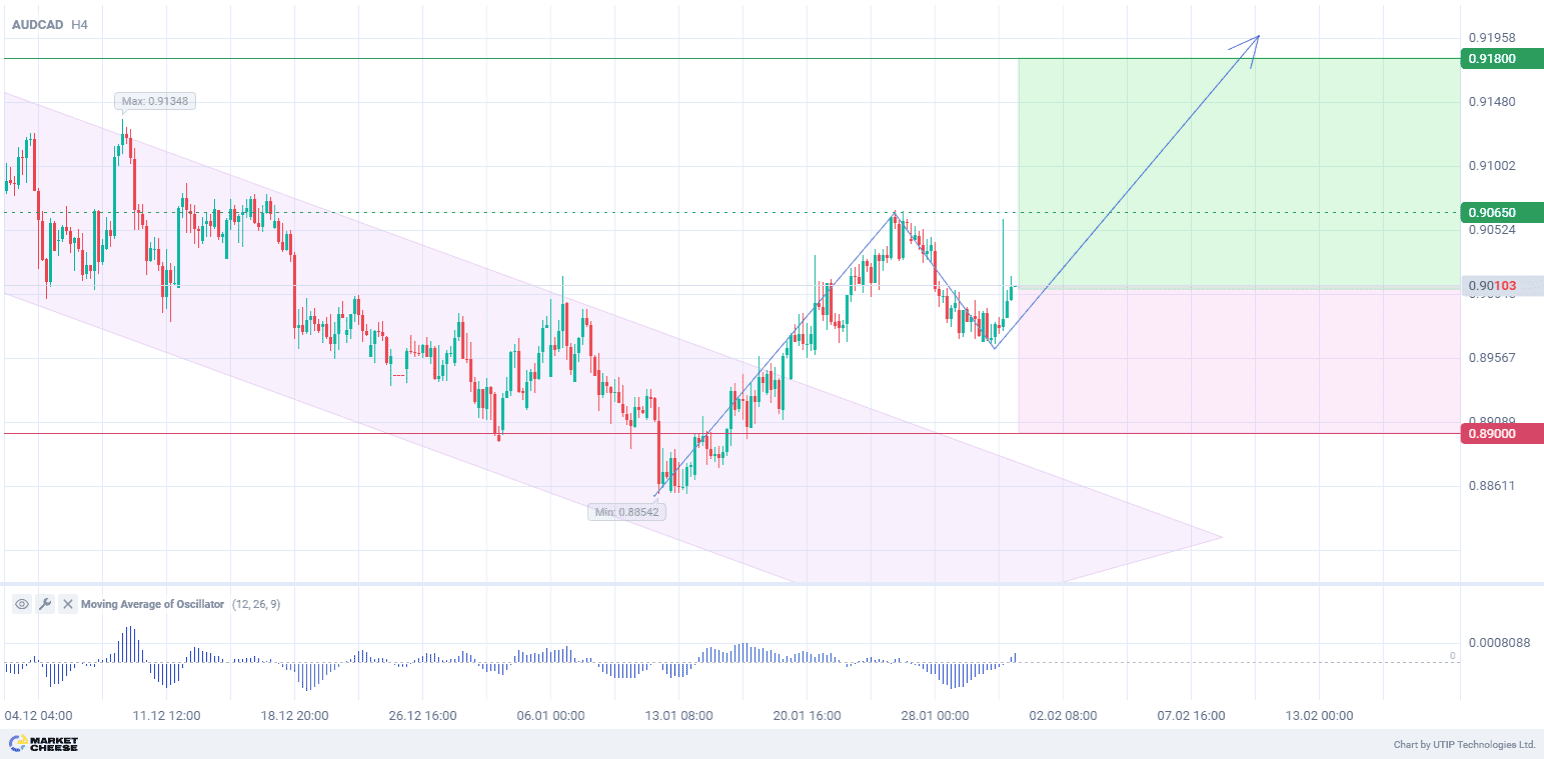

Nevertheless, despite these factors, AUDCAD continues to grow. Technically, the pair has exited the descending channel on the H4 timeframe, formed in December. In terms of wave analysis, the price is forming the second corrective wave. The Moving Average of Oscillator (with parameters 12, 26, 9) has moved to the positive zone. This strengthens the signal for the pair growth and possible transition of the second wave into the third ascending one.

Short-term prospects for the AUDCAD currency pair suggest buying with the target of 0.9180. Part of the profit should be taken near the level of 0.9065. A Stop loss could be set at 0.8900.

Since the bullish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.