On Wednesday, the USDCAD currency pair rate rises after a decline in the previous session. The pair strengthens on the background of the US dollar growth, caused by market caution before the publication of the Consumer Price Index (CPI) in the United States and a decision of the Bank of Canada on the interest rate during the North American session.

Today, investors’ attention will be focused on the CPI report to evaluate potential actions by the Federal Reserve regarding interest rates in the coming year. If inflationary pressure intensifies, the regulator may maintain rates at a high level. This will increase the attractiveness of the US dollar. At the same time, it is anticipated that the tariff policy of President Donald Trump will exacerbate inflation and economic uncertainty.

On Tuesday, Trump defended his tariff policy in a meeting with CEOs of major U.S. companies. Their market value declined due to fears of recession and inflation, which worsen consumer and investor sentiment. Later that day, Trump announced his intention to double tariffs on steel and aluminum from Canada to 50%, just hours after announcing the increase in tariffs.

Against this background, the Bank of Canada will make a decision on the interest rate today. According to LSEG data, the possibility of monetary easing by the Bank of Canada in March is estimated at 80%. This may lead to a reduction in the discount rate from 3.0% to 2.75%. Because of this, the Canadian currency may fall further.

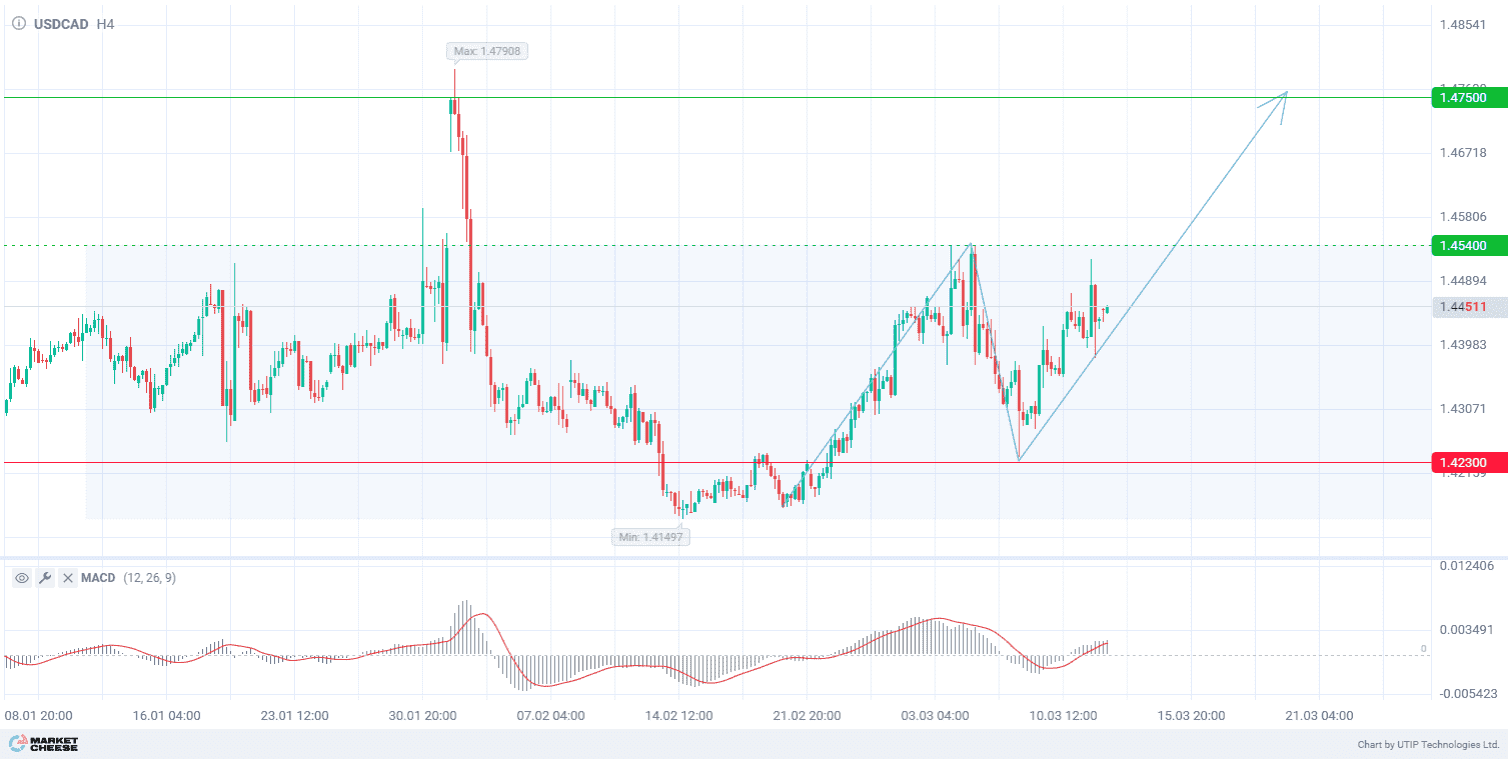

On a technical level, USDCAD quotes demonstrate market uncertainty in the form of a wide correction on the daily chart (D1). However, a clear wave structure has appeared on the H4 timeframe. The price is showing the formation of the third ascending wave, which began on March 6. Signs of growth of this wave are present. The MACD indicator (standard parameters) is increasing volumes above the zero value, confirming the growing trend.

Signal:

The short-term outlook for USDCAD is to buy.

The target is at the level of 1.4750.

Part of the profit should be taken near the level of 1.4540.

A stop-loss could be placed at the level of 1.4230.

The bullish trend is short-term, so a trading volume should not exceed 2% of your balance.