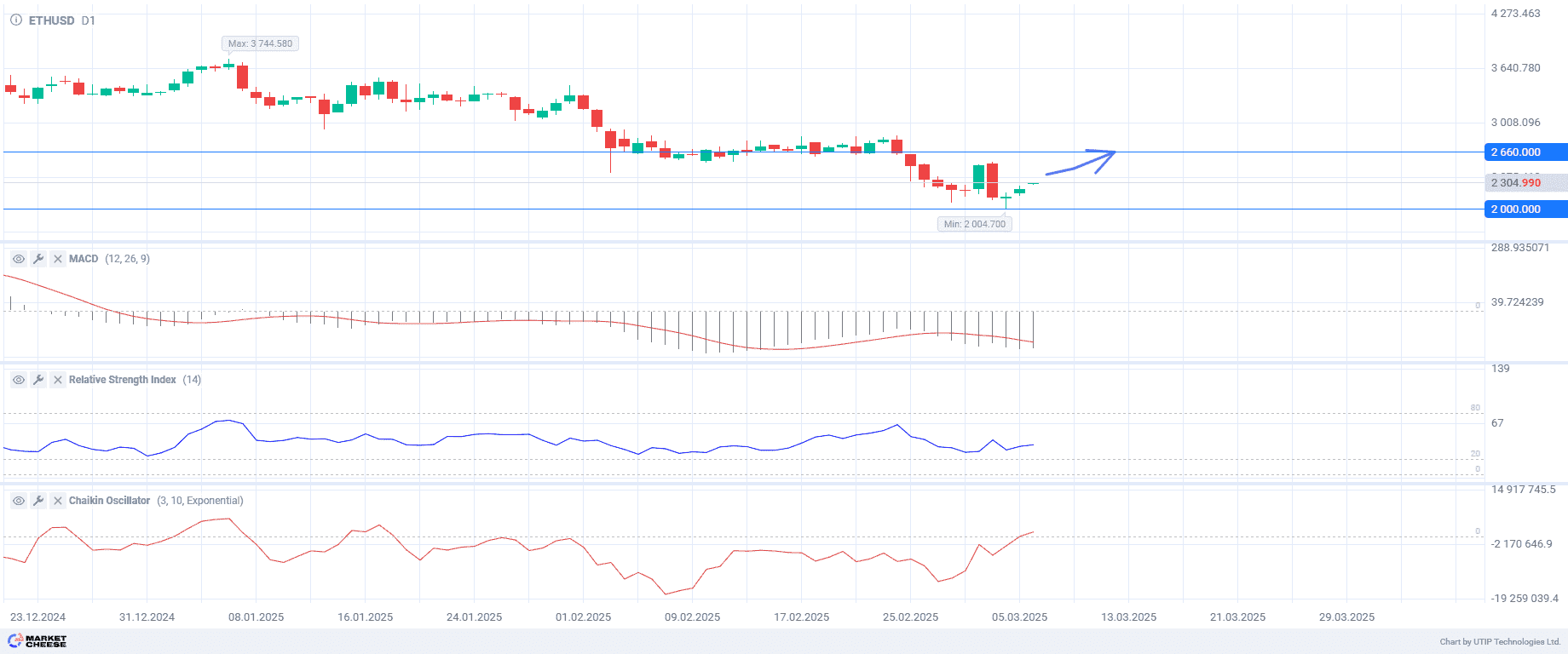

ETHUSD is recovering from a bearish reversal on March 3rd, during which the price of the cryptocurrency fell by 16.55%. On Thursday, it opened at 2281.76, having recovered 8.3% of its fall.

The drop in quotes was a market correction after a sharp rise over the weekend, caused by Trump’s plans to create a strategic reserve of cryptocurrencies.

However, the new plans failed to stop the decline seen in recent weeks. Sentiment in the cryptocurrency market has been affected by both the broad macroeconomic uncertainty caused by Trump’s protectionist policies and the response from the governments of the affected countries, as well as the recent hack of the cryptocurrency exchange Bybit and the theft of hundreds of thousands of ETH. According to the latest information, the hacker group Lazarus Group was able to fully launder the stolen funds through decentralized platforms, causing even more concern among investors about the security of cryptocurrency assets. The good news is that steps have been taken to ensure post-quantum security following the incident.

Despite what happened, there is still optimism in the cryptocurrency market about the acceptance and regulation of this type of asset by institutional players. However, it should be understood that this push to reverse the downward trend will be given by the implementation of plans and regulatory measures in the field of cryptocurrencies.

New information can be expected on Friday, March 7, when Trump is due to speak at the White House Crypto Summit. Participants will discuss regulatory policy, stablecoins supervision and their potential role in the U.S. financial system.

The technical analysis shows that the downward momentum is slowing down. The RSI is in the neutral zone, showing no signs of overbought or oversold conditions, but its value has risen from 30 to 37 in recent days, indicating that the bearish momentum is weakening. The RSI must rise above 50 for the bullish momentum to continue.

The MACD chart shows a downward trend (the MACD line is below the signal line). However, the difference between the lines is shrinking, indicating that the downward pressure is weakening. This means that the rate of decline may slow down soon, or a price correction may occur.

The value of the Chaikin Oscillator has been above zero since Wednesday. This may indicate that buyers are dominating the market, although the reading is not very high.

Current recommendation:

Buy at the current price in anticipation of positive news from the summit and growing institutional interest in ETH. Take profit — 2660.00. Stop loss — 2000.00.