Gold prices are correcting at the beginning of the week after reaching $2,786 on Friday, the highest level since late October. The strengthening of the US dollar, that recovered from the worst week since November 2023, became the main factor pressuring the precious metal.

The dollar index rose 0.3% after US President Donald Trump’s announcement about the introduction of large-scale sanctions and tariffs on Colombia. The rumors regarding possible duties on imports from Mexico and Canada, scheduled for February 1, put additional pressure on gold.

The main focus of market participants this week lies on the meeting of the Federal Reserve System on January 28-29. The regulator is expected to keep rates at the current level. However, investors will be looking for signals about the Fed’s next moves, given the Trump administration’s new initiatives. Earlier, the US president called for an immediate rate cut, reinforcing expectations of two reductions in borrowing costs in 2025.

Among the key drivers this week are US data including Durable Goods Orders, Conference Board Consumer Sentiment Index and Richmond Manufacturing Index. These reports may determine the short-term dynamics of gold.

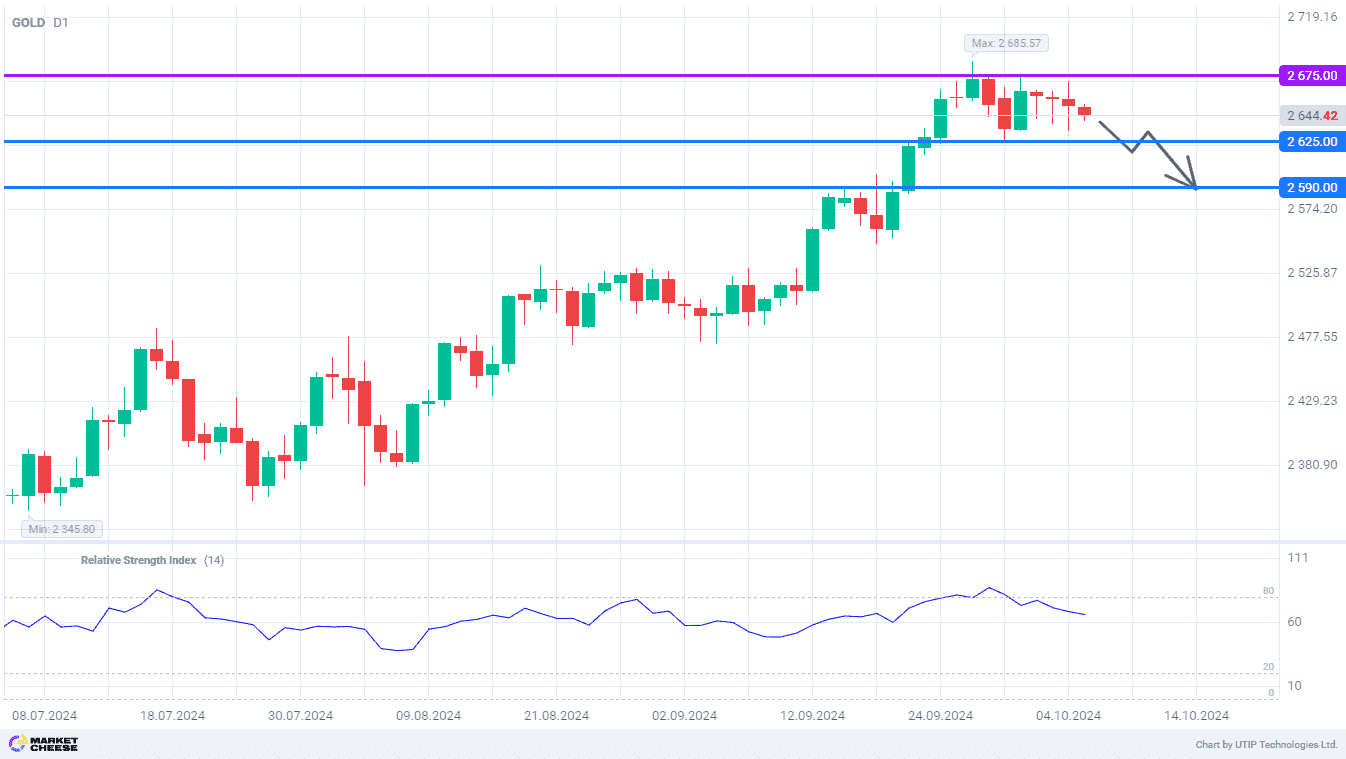

From a technical point of view, gold prices grew significantly after exiting the triangle on the daily timeframe (D1), almost reaching an all-time high of $2,790. However, the growth potential was exhausted. On the H4 timeframe, the Relative Strength Index (RSI) divergence signals a possible reversal and the formation of a new downtrend.

Signal:

Short-term prospects for GOLD suggest selling.

The target is at the level of 2690.00.

Part of the profit should be taken near the level of 2725.00.

A stop-loss could be placed at the level of 2797.00.

The bearish trend is short-term, so trade volume should not exceed 2% of your balance.