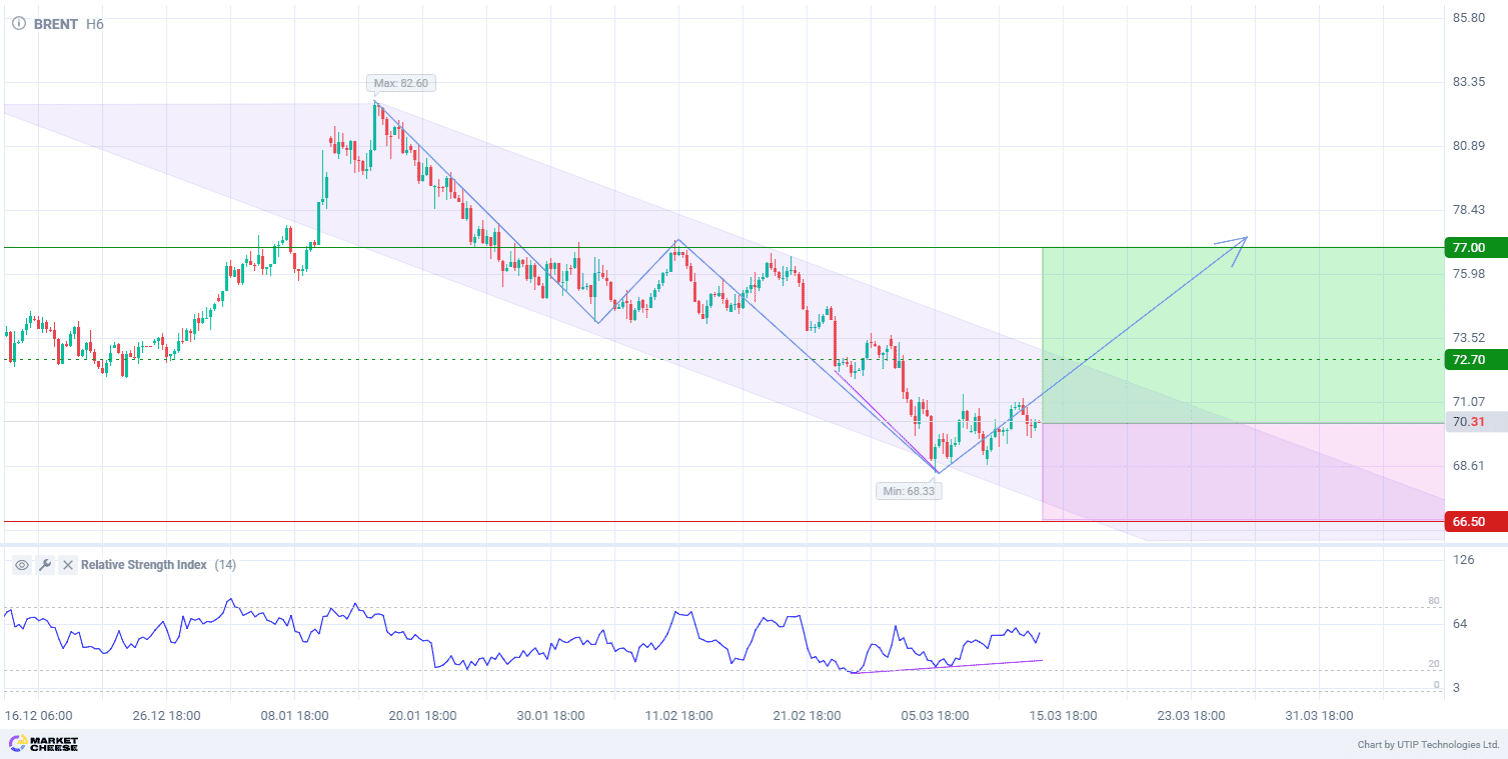

On Thursday, Brent oil prices recovered after a significant 2.5% drop on Tuesday. This was due to supply concerns after US President Donald Trump revoked a licence granted to US oil company Chevron to operate in Venezuela. On Friday, the opening oil price was at $73.31.

Trump also announced Thursday that 25% tariffs on Canadian and Mexican imports will go into effect on March 4, not April 2 as previously reported. Oil supplied by Canada to the US domestic market will also be subject to the duties, 10% tariff. Markets also remain cautious due to concerns about global economic growth and Trump’s possible increase in duties on Chinese goods, given that China is the world’s largest importer of crude oil.

The US dollar strengthened due to this news, as concerns about an escalation of the global trade war worsened market sentiment. While the threat of higher duties contributed to the dollar’s strength, it also increased concerns about the possible negative impact on the US economy.

A stronger dollar put pressure on commodities, including crude oil. But oil maintained significant gains Thursday due to President Trump’s decision to cancel Chevron’s Venezuela mining license, thus reducing supply in the market.

The upcoming important data is the release of the US Personal Consumption Expenditures Price Index on Friday, a measure of inflation that will affect Fed interest rate expectations and the dollar.

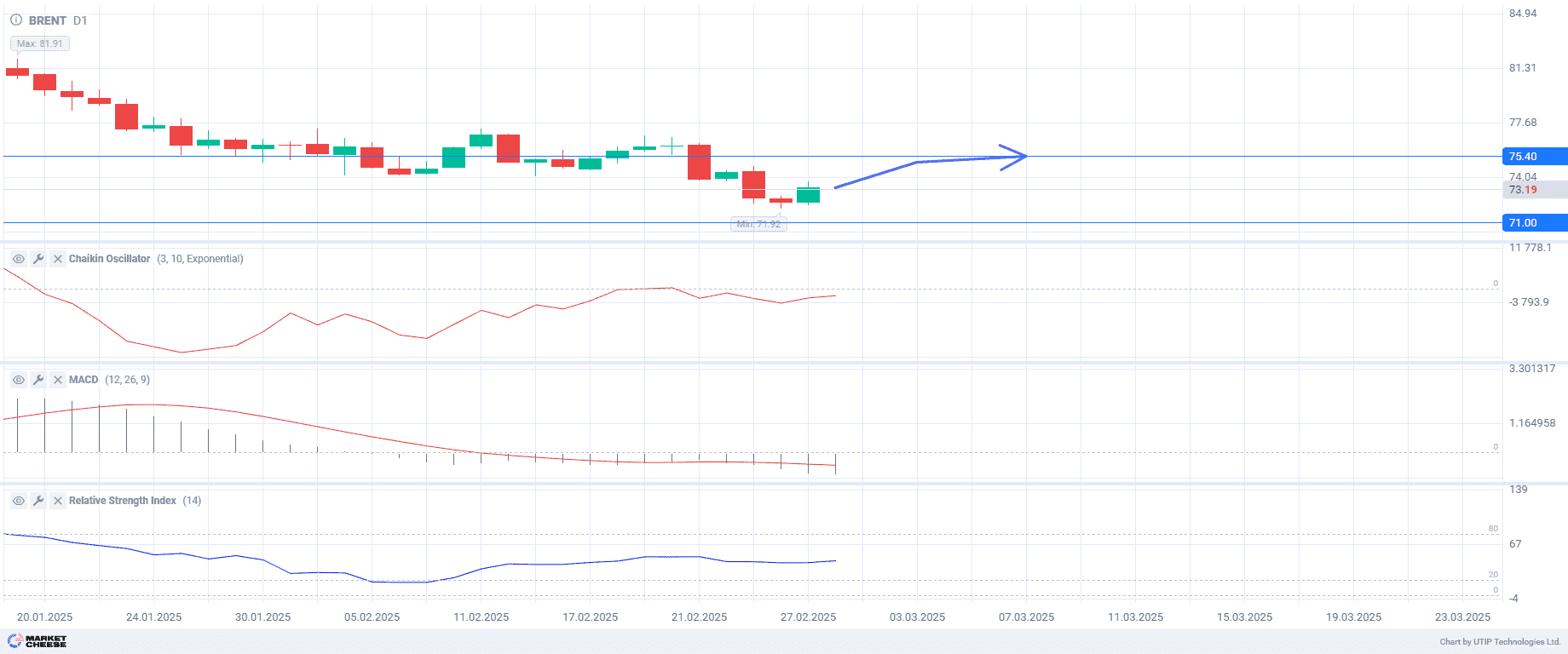

Technical analysis points to the continuation of the downtrend. The Chaikin oscillator suggests the dominance of sellers in the market, but in recent days the activity of buyers has increased slightly.

The MACD line is below the zero level, which confirms the downtrend. The MACD histogram also remains in the negative zone, and the latest data shows the strengthening of the downward momentum.

The Relative Strength Index (RSI) is around 44, indicating that the market is not overbought or oversold. It is neutral.

In the short term, we can expect prices to rise, especially before trade restrictions are imposed on Canadian oil. However, there will be significant volatility in the market, which may result in little growth.

Current recommendation:

Open a position at the current price. Take profit — 75.40. A Stop-loss — 71.00.