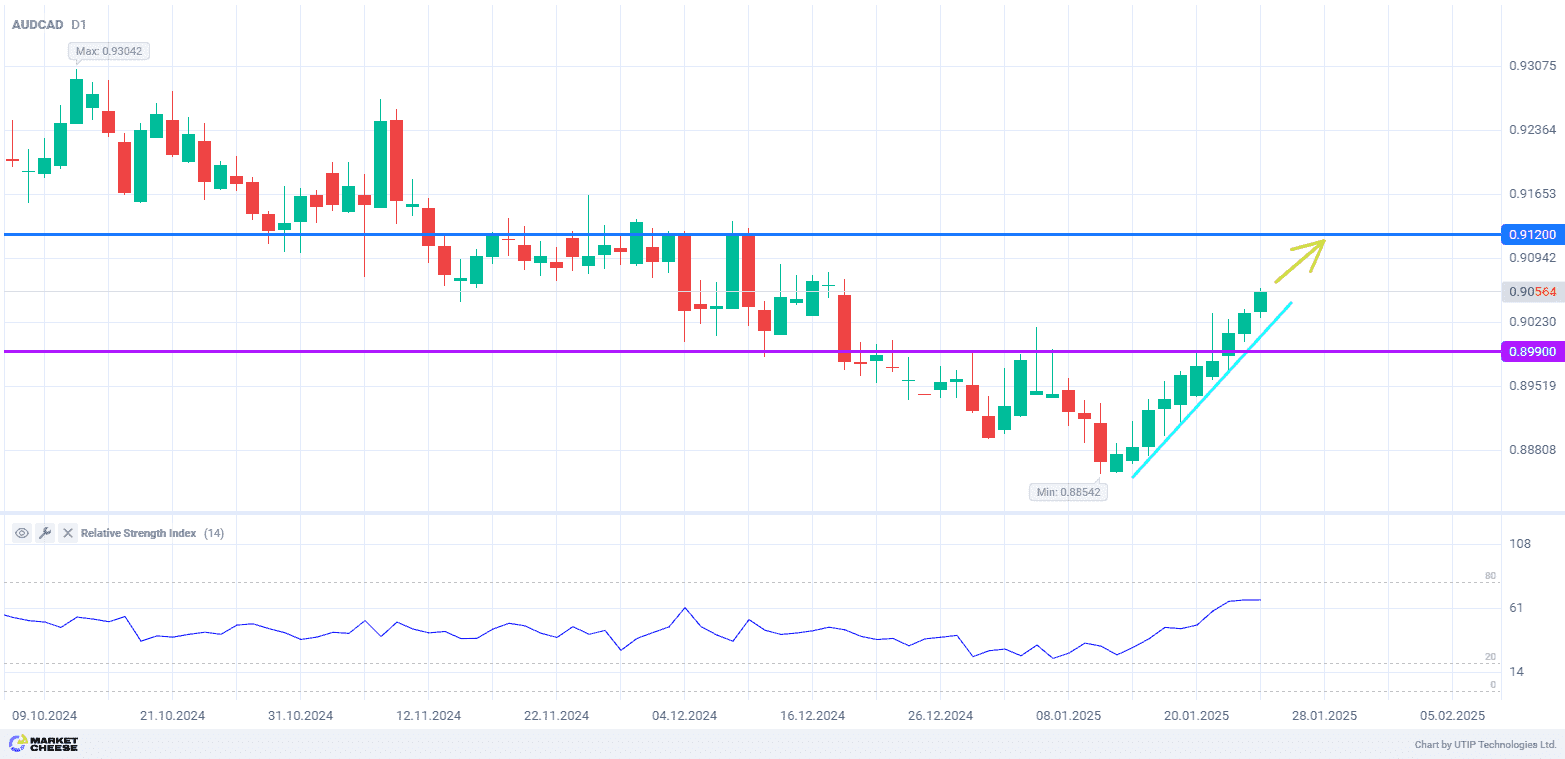

The AUDCAD pair began a gradual recovery after hitting a 5-month low at the beginning of last week. Quotes have consolidated above the 0.9 level without significant problems, and now buyers of the Australian dollar against its Canadian counterpart are targeting December highs near the 0.912 level. With technical indicators not overheating, there are no major obstacles to further gains. The changing fundamental picture also supports the bulls’ position.

The main factor pressuring the Canadian dollar is Donald Trump’s intention to impose a 25% import tariff on its northern neighbor as of February 1st. Earlier it was expected that the main victim of the new American president’s policy would be China, but in the short term it is Canada that risks becoming mainly affected. According to an analysis by Oxford Economics, a 25% tariff on Canadian goods will reduce the country’s GDP by 3% and trigger a recession.

Canada’s inflation figures for December confirm the difficulties in the Canadian economy. Price growth slowed to 1.8%, below the 1.9% expected by Reuters analysts. The Bank of Canada’s preferred measures of inflation (median and trimmed mean consumer price indices) also showed a decline. Adding to the gloom, retail sales data for November showed a lack of momentum with an expected 0.2% increase. This reflects the need for new stimulus measures from the Canadian regulator.

After evaluating this week’s statistics, the experts at Bank of America have changed their opinion and now expect another cut in the Bank of Canada’s key interest rate at the meeting on January 29. The previous forecast was for a pause in the monetary easing cycle, but now currency market participants point to a decrease in borrowing costs next week with more than 80% probability. In Australia, interest rates remain unchanged, strengthening the local currency and supporting AUDCAD growth.

Despite almost two weeks of AUDCAD gains, the RSI indicator is still not in the overbought territory. A correction signal has not yet been formed, so the price may well reach the 0.912 level by the end of January.

Consider the following trading strategy:

Buy AUDCAD at the current price. Take profit – 0.912. Stop loss – 0.899.