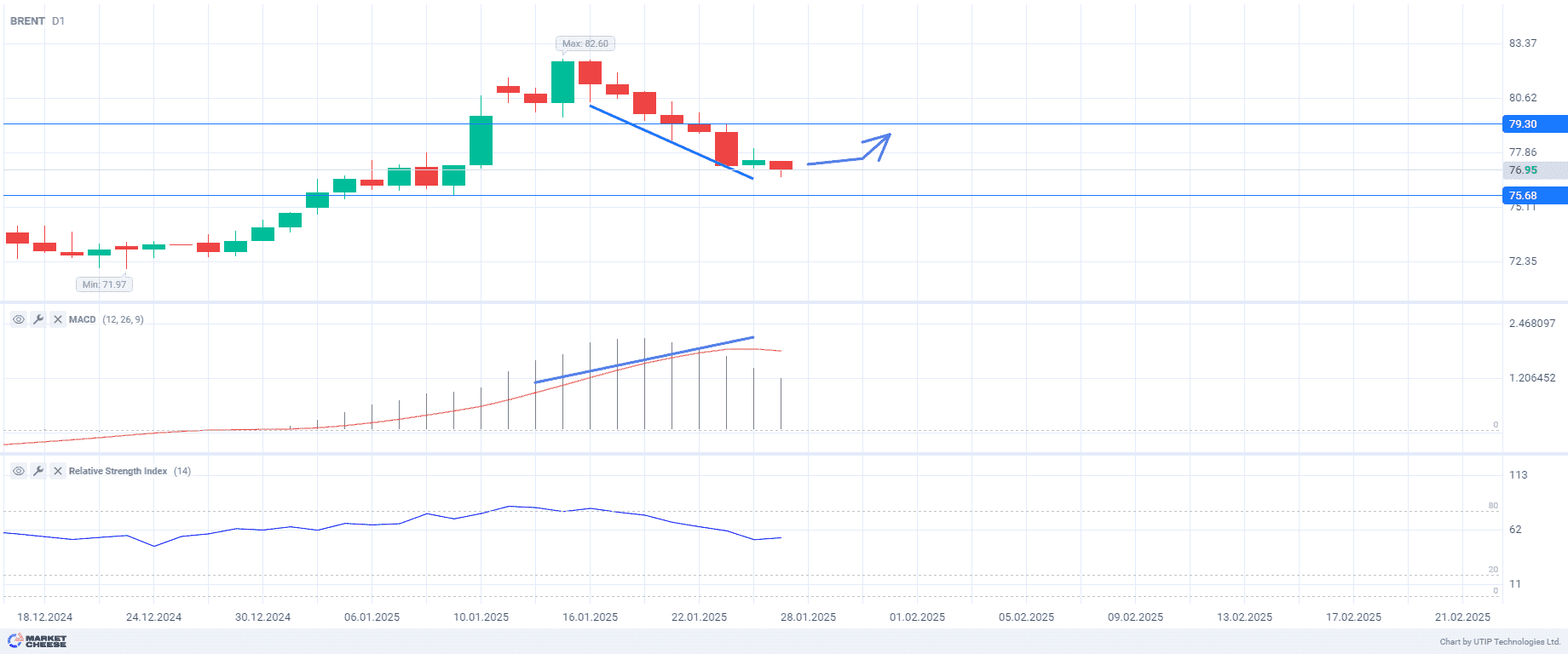

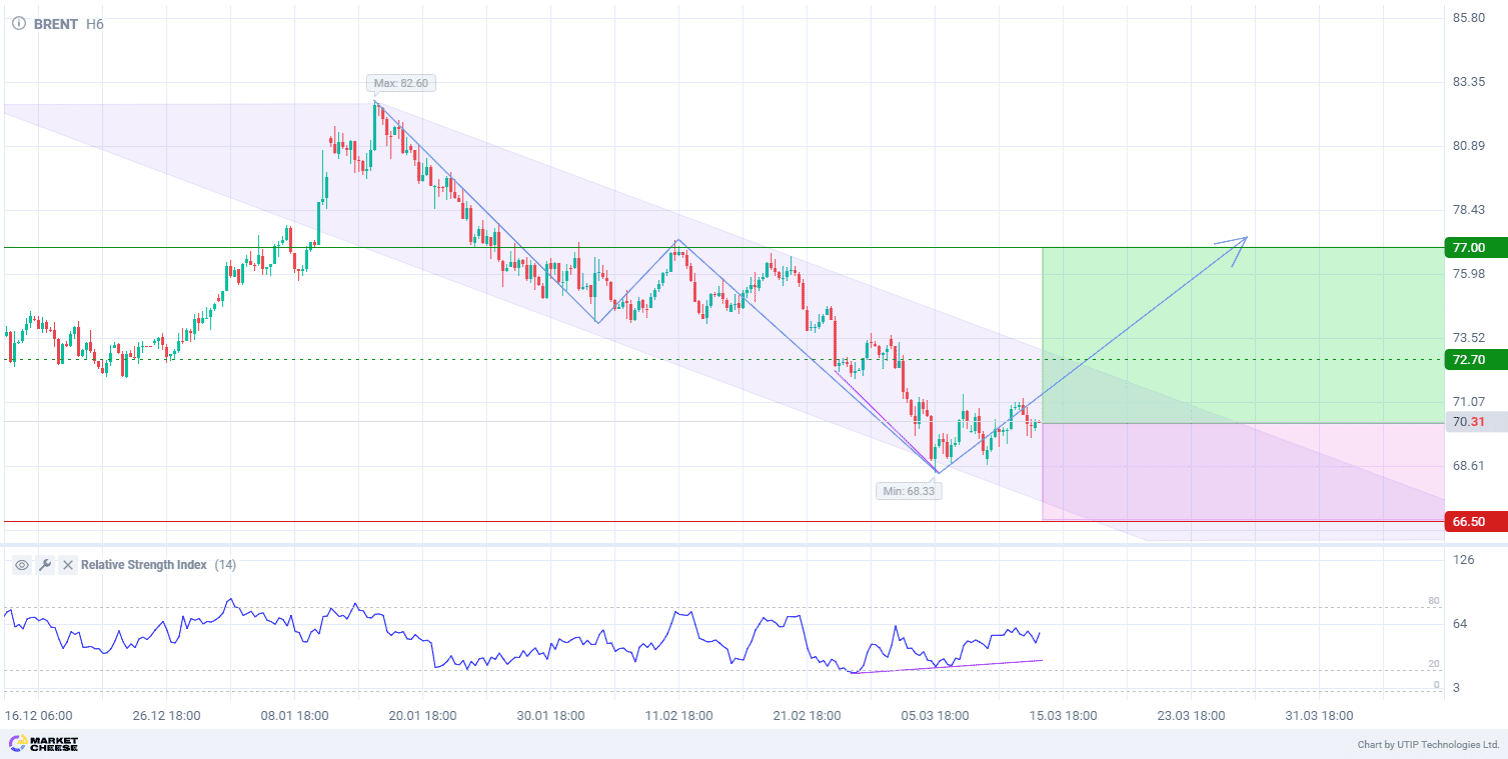

After reaching the high of $82.60 per barrel on January 15, oil price underwent a correction, falling to $77.00. As of Monday morning, the price dropped again from $77.42 to $76.95. The main reason for this decline was the imposition of tariffs and sanctions on Colombia, which undermined market sentiment and served as a reminder of larger trade risks ahead.

On Sunday, Donald Trump announced his readiness to impose 25% duties on Colombian oil, which will be raised to 50% in the future. Colombia is the fourth-largest source of foreign oil for the US, ahead of Saudi Arabia and Brazil. About one-third of Colombia’s oil exports go to the US, making these measures particularly significant for the US market. An increase in tariffs could lead to higher oil prices in the US, as it would limit access to an important source of crude.

Despite Trump’s decision to boost domestic energy production, it seems unlikely that the US oil industry will be able to meet domestic demand in the near future. Therefore, oil prices can be expected to recover in the foreseeable future.

The nearest big event is the US Federal Reserve interest rate meeting on January 29. It is expected that amid the uncertainty over Trump’s economic policies, the Fed will decide to keep the rate at the current level. This may support oil prices.

The technical analysis confirms that the overbought zone was reached on January 15 and the price underwent a correction. The RSI indicator has now stabilized, showing no clear trend signals, while the MACD indicates the end of the decline and the presence of a bullish divergence. This may suggest that oil prices will soon recover, despite the current negative factors. In general, the news background remains neutral, it is necessary to keep an eye on upcoming news.

Current recommendation:

Buy at the current price. Take profit – 79.30. Stop loss – 75.68.